Living Wage

The concept of a living wage is bigger than income. It’s about quality of life. It’s about ensuring our neighbours can afford to pay their rent and buy nutritious food, our workers are healthy and able to pay for transportation to get to work every day and our children are given sufficient social and educational opportunities so they can flourish.

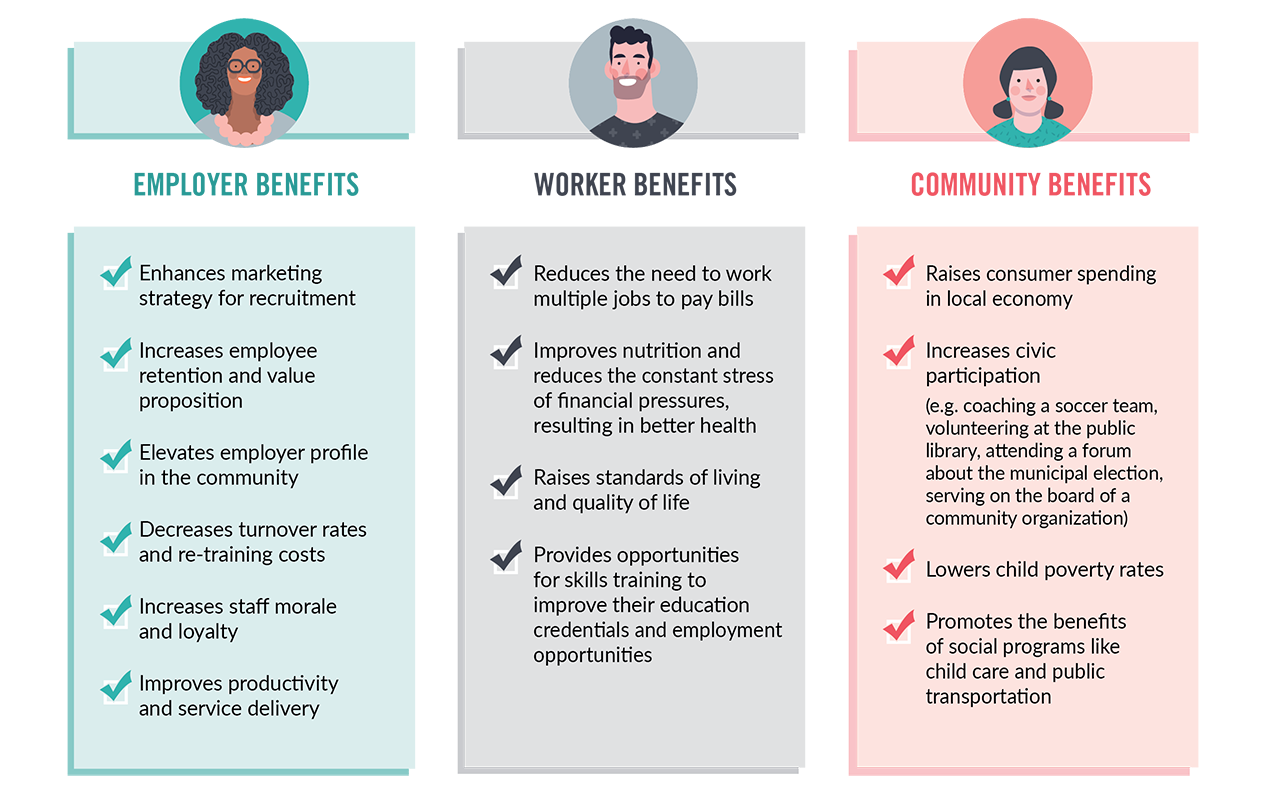

Living wage employers are responsible employers who care about their employees and the community. They recognize that paying a living wage constitutes a critical investment in the long-term prosperity of the economy by fostering a dedicated, skilled and healthy workforce.

A living wage employer pays all direct and indirect employers the living wage rate for the region(s) in which they operate.

Fostering Resiliency

Small cities and rural communities face unique challenges that requires economic resiliency and the ability to recognize new opportunities moving forward. The purpose of the Living Wage is to strengthen and support local community employers efforts to attract and retain employees.

The Living Wage is a response to the rise in precarious employment and a key part of economic growth which provides workers and their families a better way of life, benefits employers, and helps build more vibrant and healthy communities.

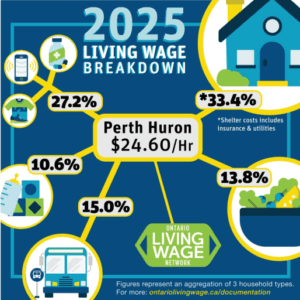

How it’s calculated

The calculation for Perth-Huron adheres to the principles and methodology developed by the Canadian Living Wage Framework as adopted by the Ontario Living Wage Network. Based on a 35-hour work week, the calculation is determined using local data and considers the living expenses of a weighted average of family types including: 1) Two working adults and two children 2) a single parent with one child and 3) A single individual.

Annual family expenses include food, childcare, clothing and footwear, shelter, communications, insurance, transportation, and parent education. Expenses such as debt repayment, home ownership, and savings for children’s education or retirement are not factored in.

Living Wage Formula

Annual family Expenses = Employment Income + Government Transfers – Payroll & Income Taxes

Steps to Certify as a Living Wage Employer

Steps to Certify as a Living Wage Employer

- Expression of Interest. Complete initial contact form below. If you have questions, email Anne Coleman, manager of the Ontario Living Wage Network (OLWN) employer program: manager@ontariolivingwage.ca.

- Application Review. The OLWN review your enrollment form and contact you to address any questions and determine the level of recognition.

- Declaration and Certificate Presentation. The employer signs the Living Wage Employer Declaration and receives their Living Wage Employer Certificate.

- Recognition. We’ll publicly recognize your organization or business through social media, events and publications. Your business or organization will be listed in our employer directory and map.

- Periodic Review. When the living wage calculation is updated, we’ll contact you to let you know the new rate. Employers have six months to make adjustments for the new rate. Ontario Living Wage Network website

Our Current Certified Living Wage Employers

A Touch of Dutch Landscaping & Garden Services Ltd.

B.M. Ross and Associates Limited

Bluewater Recycling Association

Britespan Building Systems Inc

Famme & Co. Professional Corporation

Kindred Credit Union – Milverton

Mainstreet Credit Union – Goderich

Meridian Credit Union – Seaforth

Meridian Credit Union – St. Marys

North Perth Chamber of Commerce

Peter Maranger & Associates Inc., The Co-operators

Quadro Communications Co-operative Inc.

Seaforth Co-operative Children’s Centre

South West Ontario Veterinary Services

Stratford & District Chamber of Commerce

Stratford Perth Community Foundation

Technical Training Group (Stratford and Area)

The Local Community Food Centre

The Municipality of North Perth

Trillium Mutual Insurance Company

United Way Perth-Huron

Usborne & Hibbert Mutual Fire Insurance Company

West Wawanosh Mutual Insurance Company